The Post Office is a well-known high-street brand, trusted by millions for postage, government, and financial services through its wide network of branches. However they are not the ones to deliver your mail, that is the Royal Mail, and is a different business to the Post Office.

The Post Office offers a prepaid multi-currency travel card allowing you to hold 23 different currencies. Being a prepaid travel card means you need to load money directly onto it and then reload or top up when you need more money on it. This can be done by their travel app at any time, and it allows you to then spend in any of their available currencies.

The aim is to provide an easy solution to managing your travel money abroad. The Post Office is well known for promoting a 0% commission service when taking physical cash abroad, so has been favoured by travellers for a long time.

*Rates and charges shown are correct as of 30th September 2021

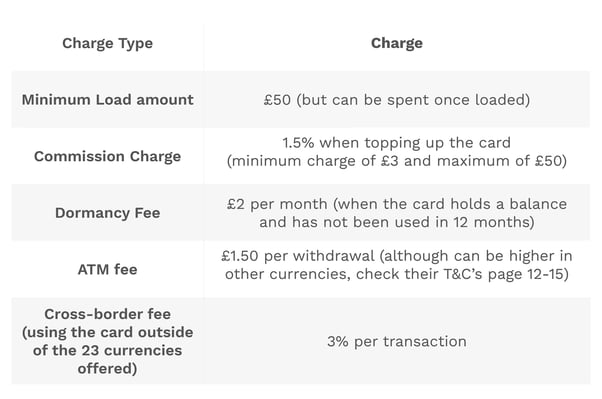

The Post Office has one simple plan, their basic Post Office Travel Money Card. While the travel money card is free to get, there is a minimum load amount of £50 of whichever of the 23 currencies you choose.

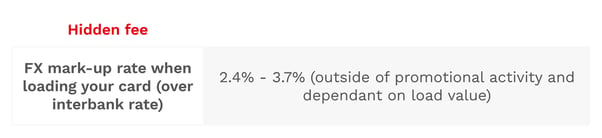

Terms such as fee-free, no commission, and zero charges are used a lot by travel money providers, and the Post Office is no different when it comes to marketing their card, which offers 0% commission. But as with most others, there is often a hidden fee under the bonnet. After all, how else would a provider make any money?

All of the above fees can be found in the Post Office terms and conditions, pages 12-15

We took a look at the EUR exchange rate they offered when loading the card before purchase, when we compare this to the interbank (real) rate we can also see a hidden charge in the FX rate of 3.8%!

A great indicator as to whether there are hidden fees or not, is if a better rate is offered when loading more money as you can see here:

Even with the better rate there is still a hidden fee of 2.4% when compared to the live interbank rate at the time.

It’s also worth noting that if you use your Post Office card to withdraw cash abroad, you will be charged at the point of loading your desired currency (the FX mark-up rate ), you will then be charged a minimum of £1.50 per ATM withdrawal on top of this. So withdrawing £100 worth of currency could cost around £5.20.

More often than not the Post Office works out more expensive than if you were to use your high-street bank account. However, you may like the functionality of separating your holiday money from your main bank account by preloading the card.

The Post Office travel card could also be a good solution if you have younger family members travelling abroad and want to help them fund their trip, but don’t want to give access to large amounts of money or for them to use their bank card while abroad. The Post Office travel money card would allow you to top up from afar and smaller amounts (although other card providers do allow limits to be set up on the card or account, which could solve this particular issue).

Currensea was founded by James Lynn and Craig Goulding in 2018, then launched in 2019 aimed at reducing hidden FX fees for travellers when spending abroad and the hassle of topping up or prepaying.

Currensea is the UK’s best rated travel debit card. The layer in front of your current bank account, saving you money, giving you extra security and making your bank work that bit harder for you.

Currensea's travel debit card partners with your current bank account to save you at least 85% on the high-street banks fees and charges on all overseas transactions. Unlike other travel cards, there is no need to prepay, no need to top-up and no need for a new bank account. Spend as seamlessly abroad as you do at home, with the money only debited from your existing bank account after you’ve spent.

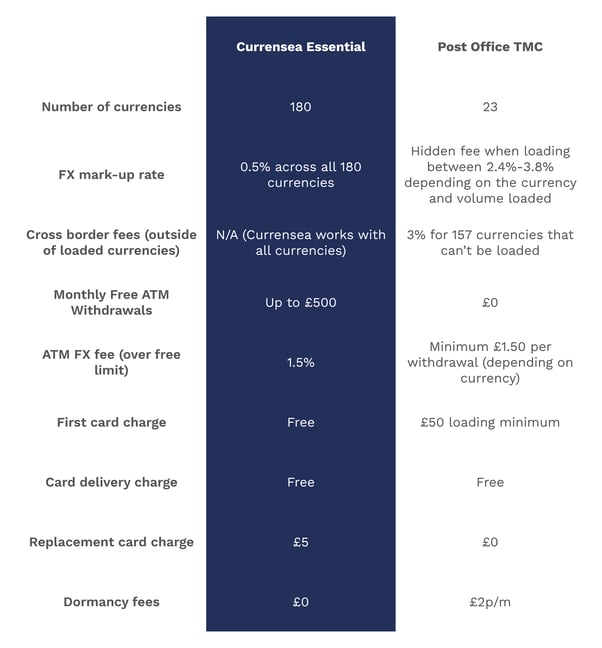

Currensea offers 15 currencies at the real (interbank) exchange rate and 165 currencies at the Mastercard exchange rate (which is the rate also used by Monzo, Starling and many other FinTechs). When signing up for the free plan, users will be charged at a flat FX mark-up rate of 0.5% over these two base rates - with no extra charges over a certain amount or at weekends, it's that simple.

Currensea's travel debit card currently offers three pricing plans. The Essential plan is free to use, the Premium plan is £25 per year and the Elite plan is £120 per year. The Essential Plan charges 0.5% FX per transaction, whereas the Premium and Elite plan incur no fees. The Elite plan also includes a host of exclusive benefits and memberships, as well as the exclusive Currensea black card.

Currensea has no additional weekend charges, or fair usage limits on any plan.

When comparing Post Office and Currensea, Currensea will always be the cheaper option when spending abroad. This is due to the hidden FX charge when pre-loading and exchanging to your desired currency on a Post Office travel money card.

More often than not, The Post Office travel money card also works out more expensive than your high-street bank, so it’s definitely important to check the exchange rate before ordering your card.

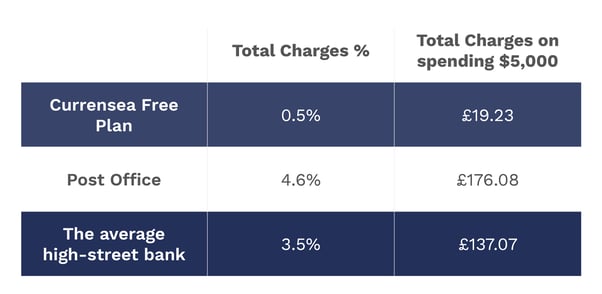

Here are the total charges when you spend $5,000 dollars ($500 of that in cash).

View our comparison table to find out more including how we calculated the above charges.

Currensea Limited is registered in England and Wales (No. 11413946), authorised by the Financial Conduct Authority (Reference No. 843507) and is a Principal Member of Mastercard. We are registered with the Information Commissioner's Office (Registration No. ZA524676).

© Currensea Limited 2022