We explained how Currensea's travel debit card can save you money abroad. We went into some detail around rates and charges, and the ‘secret sauce’ to what makes Currensea such a simple solution for better holiday money.

Now you know how the usual bank debit or credit cards attract non-sterling transaction fees, foreign currency purchase fees, and fees for cash withdrawals abroad – and how these may end up costing you more than you bargained for. We also explained how card scheme exchange rates are set and why you often don’t know what a transaction will cost you until a few days later.

In this article, we’ll give you a few examples of how these fees and charges may affect your pocket.

Currensea travel debit card

Checking out of the hotel on the weekend? Read on.

The research shows that travel money decisions are last-minute, and the holidaymakers can often find themselves in a situation when they need to quickly find the ways to settle their hotel bill on Sunday, just before rushing to the airport.

So let’s look at the following, not uncommon scenario.

Go to check out of the hotel in the US on Sunday morning. You have a $2000 bill to pay for your accommodation and all the extras. You find unspent $400 in cash you withdrew from an ATM and pay the rest $1600 by card.

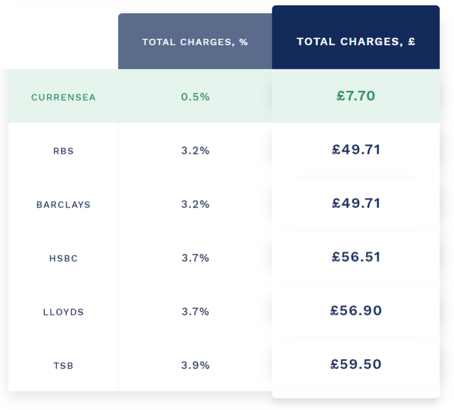

If you use a card from one of the leading high street banks

This transaction will cost you between £49.71 and £59.50 in total bank charges. The banks’ fees include non-sterling transaction charges both for card payment and ATM withdrawal, as well as the Visa exchange rate mark-up above the interbank rate.

With Currensea, this payment will cost you £7.70, which is equal to 0.5% markup above the interbank exchange rate. It means you save between £42.01 and £51.80 or 85-87%.

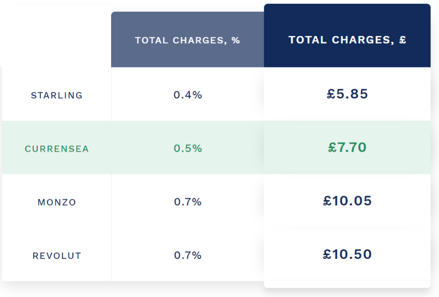

If you use a card from one of the challenger banks

It would cost you between £5.85 and £10.50 in total charges, as challenger banks do not charge non-sterling transaction fees. However, both Revolut and Monzo do charge a 2% or 3% fee for an ATM withdrawal above the equivalent of £200, Revolut applies a weekend surcharge of 0.5%, and Monzo uses a card scheme rate with the mark-up built into it. Starling offers the best deal, as the only markup they apply is a card scheme one.

In this case, Currensea’s fee of £7.70 could still save you up to £2.80 or 27%.

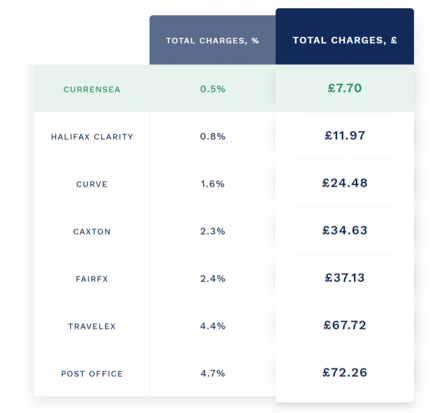

If you use other travel money card, such as prepaid travel cards

This payment scenario would cost you between £11.97 and £72.26 in total charges. This is because prepaid cards, such as Caxton or FairFX, charge top-up and conversion fees for card payments and ATM withdrawals, Curve applies 2% markup above a £500 limit and a weekend fee of 0.5% and Halifax Clarity charges interest for an ATM withdrawal from day one.

Currensea’s fee of £7.70, in this case, will save you between £4.27 and £64.56 or 35% to 89%.

Using cards abroad is costing us a fortune, and Currensea is on a mission to change this

Latest figures highlight that Brits perform over 1.5bn transactions outside the UK each year with debit cards equating to spend of over £46bn*. Based on the average charges across five major UK high street banks, this equates to a whopping £1.5bn** per year that we are paying out to use our debit cards abroad.