At the moment Currensea users can send funds from their UK bank account to either a EUR, USD, PLN or HUF account. These are the only currencies currently supported by Currensea money transfer, but more currencies will be added in the future.

0.5% flat fee on all money transfers!

With the same interbank exchange rate as your Currensea travel debit card and a small flat fee of 0.5%, sending money overseas is now even simpler and more transparent than ever before. Send between £100 and £20,000 per transfer from your UK bank to a EUR, PLN, HUF or USD account.

If you already have a Currensea travel debit card, you can log into your account via the app and use our money transfer calculator before completing a transfer. Alternatively, click the button below.

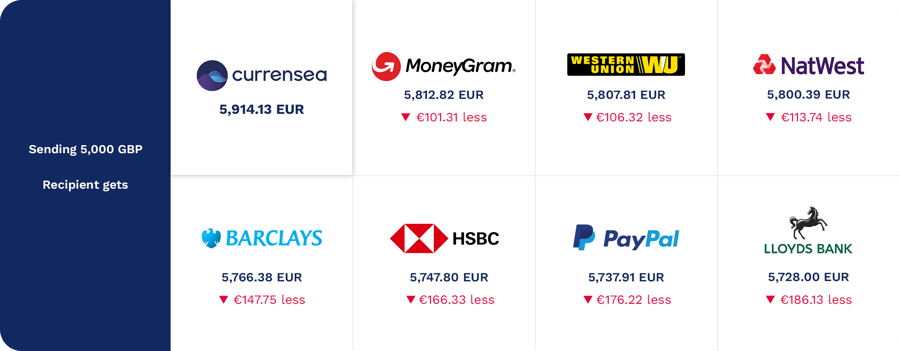

Money transfer comparison

Here’s how Currensea compares against typical high street banks and other leading providers for a £5,000 transfer into Euros.

*Prices shown above reflect our Premium and Elite Plans and are correct as of 24.03.22

Money transfer FAQs

At the moment Currensea users can send funds from their UK bank account to either a EUR, USD, PLN or HUF account. These are the only currencies currently supported by Currensea money transfer, but more currencies will be added in the future.

The same interbank exchange rate as your Currensea card and a small flat fee of 0.5%

As Currensea works through open banking technology, our accounts only partner with UK based bank accounts. This means that you are able to send funds to overseas USD, EUR, PLN and HUF accounts but can’t yet send money from abroad to your UK bank account.

It’s really easy to add a new recipient that you would like to transfer money to. Simply follow the steps on your Currensea dashboard and you will be given the option to either choose an existing recipient or add a new recipient. If you select ‘add a recipient’ you will be given a list of required details, be sure to fill out the correct information to avoid issues with lost funds.

IBAN is short for International Bank Account Number. This is a long account number used by banks for cross-border transfers. Each country structures this number differently, but it always starts with a 2 digit country code (e.g. DE for Germany).

Every bank account has a unique IBAN code, and this is required when sending funds internationally. IBANS are issued by many banks in Europe and other banks internationally are starting to recognise them as well.

When setting up a new recipient you will need the IBAN of the account you wish to send funds to. The IBAN can be found by logging into your online banking or by checking bank statements.

If you are sending funds to the US you will be required to enter the Account Number and Bank Routing Number instead of an IBAN. A Bank Routing number is a 9-digit code assigned to each financial in the United States. When you enter this alongside a payee’s account number it will help identify the exact bank account for your money transfer, similar to a sort code in the UK.

Funds received before 9pm UK time weekdays should reach the recipient’s bank account the following business day. Funds received over a weekend should reach the recipients bank account the following Tuesday.