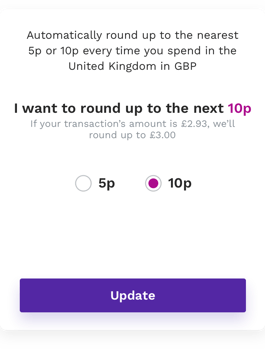

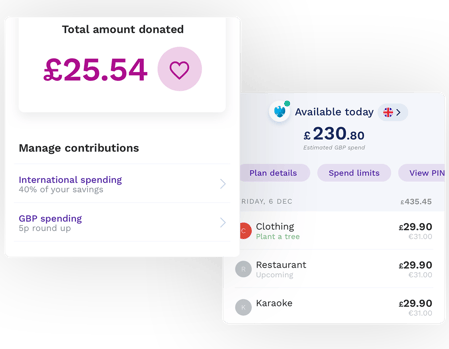

Round-up to the nearest 5p or 10p

Donate pennies with every spend you make, by rounding up on each purchase. This can be done easily via direct debit.

Connects to your

existing bank account

- Currensea is the layer in front of your current bank account

- It saves you at least 85% in bank fees on every foreign transaction

- Gives you extra security and makes your bank work that bit harder for you

Currensea uses

online banking

- Your bank uses online banking to allow you to connect your St Martin-in-the-Fields charity debit card safely and securely

- No new bank account needed - all you need to do is link your new charity debit card to your existing debit account when you sign up

- Transactions are protected by Mastercard's 120-day chargeback protection

Spend with your

new card

- Donate pennies with your everyday purchases

- Manage and track your donations via our app

- When you spend, Currensea collects the funds from your bank account via Direct Debit

Currensea's connected bank

Currensea works with all the major UK high-street banks

Currensea is rated Excellent on Trustpilot

Currensea is rated 'Excellent on Trustpilot with a score of 4.8/5 from thousands of reviews!

Your new card will save you money when abroad!

You will no longer need to pay the normal bank fees when travelling abroad. Instead you keep that saving yourself OR donate it to St Martin-in-the-Fields! Best of both worlds!

About St Martin-in-the-Fields Trust

St Martin-in-the-Fields has been serving London for centuries, and while our building might be nearly 300 years old, our commitment to be here for everyone who needs us is unwavering.

Have full control using the Currensea App

Download Currensea's easy-to-use app and donate to FSt Martin-in-the-Fields as much or as little as you want per purchase. Currensea's app experience is much easier than you’d ever imagined.