Prepaid travel cards

Prepaid travel cards are an alternative to carrying cash abroad and can be used like a debit card. You can preload your card either with your choice of currency at a set exchange rate, or with GBP which will be converted into the local currency at the exchange rate on the day. Prepaid travel card providers offer different exchange rates; some use the interbank rate and others use Mastercard or Visa’s exchange rates. In some cases, a provider may choose one of these rates and then apply a percentage on top.

Some prepaid cards are linked to an app

Many cards are linked to an app where you can check your balance, reload your card if your funds run out, and review your transaction history. However, prepaid travel cards often come with a variety of fees and charges including application fees, monthly fees, ATM withdrawal fees, inactivity fees and redemption fees.

A new solution

A new solution, only offered by Currensea, the UK's best rated travel debit card. Currensea connects via Open Banking to your existing debit card and is accepted anywhere which accepts MasterCard. Plus, Currensea use the best live interbank exchange rate for 16 separate currencies (which is what the banks use between them), this guarantees that you'll receive the best current exchange rate every time you use your card. Plus there are no hidden fees and charges like most Prepaid travel cards. One of the UK's most popular prepaid travel card is from the Post Office, read our review here which covers information on their fees.

No video selected

Select a video type in the sidebar.

5 Things to consider before choosing a travel money card

1. What’s the rate?

Prepaid cards offer a huge range of rates that might not be as good as the rate offered by your bank. Whilst almost all providers say no fees, the fee is often hidden in the exchange rate.

2. Does your travel money card offer protection?

Some cards are covered by section 75 protection, but not all, it’s worth checking the T&Cs before you sign-up to ensure that all your purchases will be covered by some kind of chargeback protection.

3. Can you get back unused currency?

Once your holiday has finished you’re unlikely to want to leave any leftover currency on your travel money card. Make sure that you can easily get your money back, without incurring further fees.

4. Are there any hidden fees?

Check for any fees, prepaid cards generally have more hidden fees than credit or debit cards. Make sure that you keep an eye out for fees such as application and replacement fees, transaction fees, and inactivity charges.

5. Are there any limitations to where you can use the different types of cards?

All providers say that they can be used wherever you see the Visa or Mastercard logo but there are some big exceptions that may impact your choice. If you want to pay at a petrol station, hire a car, or pay on a cruise - generally, you can only use a Credit, Debit, or Currensea’s travel debit card - prepaid travel cards are often not accepted.

See how much you can save using a

Currensea travel debit card

Save in 180 currencies vs high street banks, travel money cards or any prepaid travel card.

| TOTAL CHARGES, £ | TOTAL CHARGES, % | |

| ELITE & PREMIUM PLAN |

£0

|

0%

|

| ESSENTIAL PLAN |

£20.55

|

0.5%

|

| RBS |

£134.37

|

3.27%

|

| BARCLAYS |

£144.24

|

3.51%

|

| HSBC |

£141.26

|

3.44%

|

| SANTANDER |

£152.75

|

3.72%

|

| LLOYDS |

£174.74

|

4.25%

|

| TSB |

£204.4

|

4.97%

|

| TOTAL CHARGES, £ | TOTAL CHARGES, % | |

| ELITE & PREMIUM PLAN |

£0

|

0%

|

| ESSENTIAL PLAN |

£20.55

|

0.5%

|

| CURVE + £4.99 card delivery |

£89.02

|

2.17%

|

| CAXTON |

£92.46

|

2.25%

|

| FAIRFX |

£94.46

|

2.3%

|

| TRAVELEX |

£180.81

|

4.4%

|

| POST OFFICE |

£187.92

|

4.57%

|

Why is Currensea better than a travel card?

We link with your current bank account via Open Banking to make saving money simple.

You can find out more about Open banking here

No new bank

account needed

Forget having to set-up and manage multiple accounts

No need to

top-up or pre-pay

Remove the hassle and inconvenience of pre-loading another card

No ATM fees

Pay no ATM fees if you withdraw under £500

Your account is secure with Currensea

Authorised by the Financial Conduct Authority

Freeze your card anytime at the click of the button via the app

All purchases protected by Mastercard Chargeback Protection

Our connected banks

We work with all the major UK high-street banks

Currensea pricing plans

Our plans are simple and transparent. We give you the best live exchange rate so you can spend in confidence, without the hidden fees.

£0/year

Saves 85% on bank charges*

Across card spend & ATM withdrawals

Spend notifications, set spend limits & freeze/unfreeze card

Mastercard chargeback protection

Get the best live interbank exchange rates

Mastercard travel debit card

Across card spend & ATM withdrawals

Spend notifications, set spend limits & freeze/unfreeze card

Mastercard chargeback protection

Get the best live interbank exchange rates

Mastercard travel debit card

Access our latest offers for Premium travel debit card users

Including Hertz Gold Plus Rewards with complimentary Five Star Status and a 20% worldwide discount with Avis

£120/year

Saves 100% on bank charges*

Across card spend & ATM withdrawals

Spend notifications, set spend limits & freeze/unfreeze card

Mastercard chargeback protection

Get the best live interbank exchange rates

Mastercard World Elite travel debit card

Access our latest offers for Elite travel debit card users

Exclusive membership to Avis President's club and Hertz's President's Circle

Enjoy 4 nights for the price of 3 and other exclusive benefits with 'Elite I Prefer Member Status'

LoungeKeyTM warmly welcomes you to access 1100+ airport lounges

Explore 3,000+ locations with extravagant benefits incl complimentary breakfast, room upgrades and much more

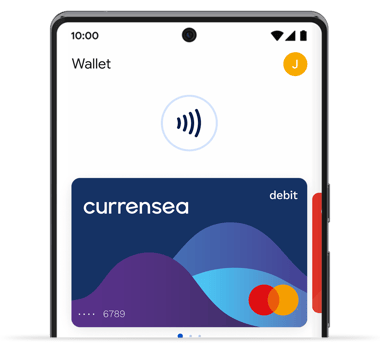

Tap to Pay With Google Pay™

Get all the benefits of your Currensea travel debit card conveniently on your phone. Just add a card to Google Wallet™ to get started.

No hidden fees

No weekend charges, non-sterling transaction fees, foreign currency purchase fees, internet purchase fees or dormant card fees.

As seen in

No video selected

Select a video type in the sidebar.